Gulf Coast title loans TX offer fast cash solutions for Texas residents using their vehicle as collateral, with simpler requirements and faster turnaround times than traditional bank loans. Ideal for emergencies or unexpected expenses, these secured loans allow borrowers to retain vehicle ownership but carry higher interest rates and repossession risks. The 6-step process involves checking eligibility, choosing a loan amount, applying online/in-person, providing documents, vehicle inspection, and signing loan documents after term confirmation. Alternatives like motorcycle title loans or debt consolidation are recommended for long-term financial stability.

“Discover the power of Gulf Coast Title Loans TX – a comprehensive guide for Texans seeking quick liquidity. This article unravels the process, benefits, and considerations behind these unique loans, offering a clear path for borrowers. From understanding the basics to mastering the application, we navigate the landscape of Gulf Coast title loans TX. Learn how this option can provide fast funding while leveraging your vehicle’s equity, making it an attractive solution for immediate financial needs.”

- Understanding Gulf Coast Title Loans TX: Unlocking the Process

- Benefits and Considerations for Borrowers in Texas

- How to Apply: A Step-by-Step Guide to Securing Your Loan

Understanding Gulf Coast Title Loans TX: Unlocking the Process

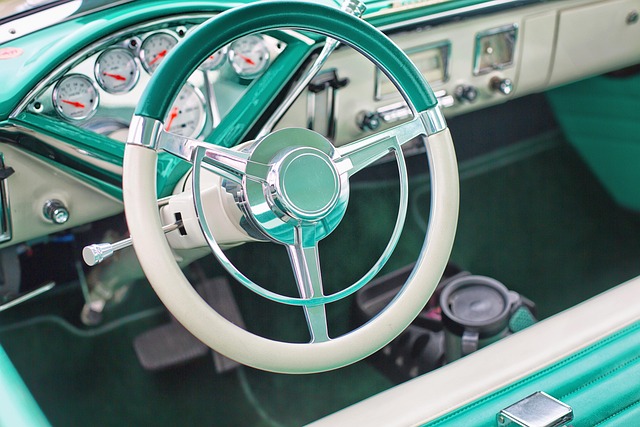

Gulf Coast title loans TX offer a unique financial solution for residents in need of quick cash. This process revolves around the use of an asset, typically a vehicle, as collateral. By leveraging the value of their vehicle, borrowers can access substantial financial assistance, known as a loan, which can be used for various purposes, including emergency funds or other urgent needs.

Understanding how Gulf Coast title loans TX work is essential. The process involves assessing the vehicle’s worth, verifying the borrower’s identity and income, and determining the loan amount. Once approved, borrowers receive their funds promptly, and they retain ownership of their vehicle. Unlike traditional bank loans, these titles loans often have simpler requirements and faster turnaround times, making them an attractive option for those seeking financial flexibility, especially when it comes to urgent matters or unexpected expenses. This alternative financing method can be particularly beneficial for individuals looking for quick financial assistance, even for semi truck loans in specific cases.

Benefits and Considerations for Borrowers in Texas

Gulf Coast title loans TX offer several benefits for borrowers in Texas looking for quick cash solutions. One of the main advantages is their accessibility; these loans are secured by the value of your vehicle, making them an option even for those with less-than-perfect credit. This type of loan allows you to keep your vehicle while accessing a lump sum of money, which can be particularly useful in emergencies or for unexpected expenses. Moreover, the process is relatively straightforward and often faster than traditional bank loans, as there’s no need for extensive paperwork or credit checks.

Considerations for borrowers include understanding the interest rates and repayment terms. While these loans can provide a financial safety net, they typically come with higher interest rates compared to other types of borrowing due to the collateral involved. Additionally, it’s crucial to weigh the benefits against potential risks, such as repossession if you fail to make payments on time. For some borrowers, Gulf Coast title loans TX might be ideal for short-term financial needs, but they should also explore alternatives like motorcycle title loans or even debt consolidation options if a longer-term solution is more sustainable. Vehicle inspection is another key aspect; lenders will assess your vehicle’s value and condition to determine the loan amount, so ensuring your vehicle is in good working order can be beneficial.

How to Apply: A Step-by-Step Guide to Securing Your Loan

Applying for a Gulf Coast Title Loan TX is a straightforward process designed to get you the funds you need quickly. Here’s a step-by-step guide to securing your loan:

1. Determine Eligibility: Before applying, ensure you meet the basic loan requirements, such as being at least 18 years old with a valid driver’s license and a clear vehicle title in your name.

2. Choose Your Loan Amount: Decide on how much you need from the range offered by Gulf Coast Title Loans TX. Keep in mind that the loan amount will be based on the vehicle valuation.

3. Fill Out the Application: Visit the lender’s website or physical location and download/complete the application form. Provide accurate information about your vehicle, including make, model, year, and mileage.

4. Provide Necessary Documents: Gather essential documents like your driver’s license, proof of insurance, and vehicle registration. You may also need to present proof of income.

5. Vehicle Inspection: A representative from Gulf Coast Title Loans TX will conduct a vehicle valuation inspection to assess the condition and value of your vehicle.

6. Review and Sign Documents: Once the inspection is complete, review the loan terms and conditions carefully. If everything aligns with your expectations, sign the necessary documents to finalize your Gulf Coast Title Loan TX.

Gulf Coast title loans TX offer a secure and accessible borrowing option for Texans in need of immediate financial support. By understanding the process, considering the benefits and drawbacks, and following a straightforward application guide, borrowers can make informed decisions about using their vehicle’s equity as collateral. Remember, while these loans provide quick cash, responsible borrowing practices are essential to avoid hefty interest rates and potential negative impacts on future finances.